ASCO 2023 – Novartis’s Adjuvant Breast Cancer Win Comes With Caveats

Executive Summary

The Natalee trial hits in all-comers, but an equivocal showing in node-negative patients raises questions about market expansion.

Novartis AG’s self-proclaimed hit in the Natalee trial with the breast cancer drug Kisqali was always going to be about the details. Late-breaking results presented at the American Society of Clinical Oncology annual meeting suggest that the Swiss group will have to fight hard to grab share from Eli Lilly and Company and its incumbent Verzenio, and to justify an immediate expansion into new patient groups.

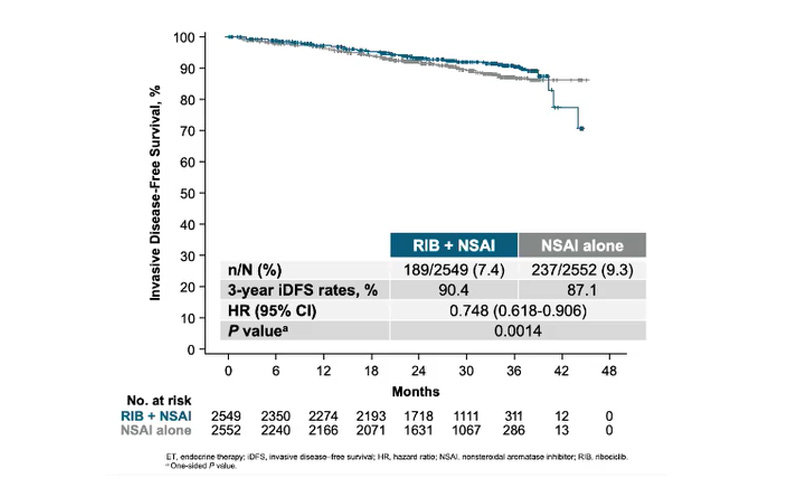

Not that the trial is unsuccessful, with an ASCO abstract describing a solid 25% reduction in the risk of reccurrence (HR 0.748; p=0.0014), a result that should be sufficient to expand Kisqali’s label into the lucrative adjuvant setting. But investor exuberance earlier this year was driven by Novartis’s claim to have seen a consistent benefit across subgroups, and that remains unclear pending full presentation of the results at the medical conference later today.

Jefferies analysts, for instance, wrote recently their “base case” expectation was for an iDFS hazard ratio for the all-comers primary endpoint of around 0.65-0.70, with key subgroups also within that range. 0.75 seems to fall well short of this.

And an important hint was revealed at an embargoed press conference ahead of the conference by the study’s lead author, Dr Dennis Slamon of the UCLA. He disclosed that the hazard ratio for a closely watched subgroup, node-negative patients, was 0.63, but cautioned that the confidence interval crossed above 1.00; this implies that any numerical benefit here remains unproven.

Lilly’s similar adjuvant trial, MonarchE, excluded node-negative patients, who are considered at a lower risk of recurrence. As such, showing a clear benefit here could open a large new patient group exclusively for Novartis to tap. Full results remain crucial to know, but regulators have been cautious about exposing low-risk patients to these agents before, and that confidence interval could prompt concerns.

Slamon said that of the more than 5,000 patients recruited into Natalee around 600 were node-negative.

Topline hit

The setting that Novartis is seeking to contest here is early-stage, ER-positive/Her2-negative breast cancer; Kisqali, a CDK4/6 inhibitor, is already approved for metastatic disease. Surgery, chemo or radiotherapy and hormone adjuvant therapy, which can be dosed for up to a decade, cure around 70% of cancers that have not metastasised.

Developers have been striving to show that the addition of adjuvant CDK4/6 inhibition can push the recurrence rate down. Lilly succeeded here by focusing MonarchE on patients at high risk of relapse, and Novartis was striving to repeat that finding while pulling in certain lower-risk subjects.

MonarchE specified that patients should have lymph node involvement and at least one other measure of a higher risk of occurrence. Natalee allowed some patients deemed node-negative, and the difference is huge commercially: Novartis reckons Natalee’s addressable population is two to three times larger than MonarchE’s, and analysts reckon the opportunity runs to a couple of billion dollars in extra sales.

At Esmo in 2020 Lilly unveiled a 25% reduction in the risk of cancer returning within two years – a result that Novartis appears to have matched, differences in patient composition notwithstanding. But, to complicate this picture further, MonarchE comprised two cohorts, with relatively lower-risk patients assigned to cohort 2. A much better response in cohort 1, representing 91% of subjects, prompted the FDA to restrict its approval to this group.

Verzenio's label states the more competitive 0.653 hazard ratio achieved in cohort 1. All eyes will be on the subgroup hazard ratios in Natalee, to enable these two results to be compared side by side.

Natalee primary endpoint: invasive disease-free survival

There are other very important differences that should be remembered: Novartis treated patients for three years in Natalee, for example, as opposed to two years for Lilly's MonarchE.

But Lilly’s regulatory experience shows that the FDA is mindful of unnecessarily exposing to a drug those patients who might not benefit from it. The Natalee abstract states that around 25% of patients discontinued, and at the press conference Slamon presented adverse event data showing that Kisqali’s known neutropenia and QTc prolongation issues remained, despite a drop in the drug's dosage versus the metastatic setting.

Still, this trial was stopped at an interim analysis for a reason. As Wolfe Research analysts wrote recently, an adjuvant breast cancer label takes Kisqali from being an "also-ran" to a major contender. Over to regulators to decide whether the benefits shown in lower-risk patients are persuasive.

– Amy Brown ([email protected])

This article originally appeared in Evaluate Vantage. Evaluate Vantage and Scrip are part of the same parent company, Norstella.